Accounting software like QuickBooks Online lets you run a balance sheet report for the beginning and the end of the period to obtain these numbers. We have a guide and video on how to create a balance sheet report in QuickBooks Online. The portion of A/R determined to no longer be collectible – i.e. “bad debt” – is left unfulfilled and is a monetary loss incurred by the company.

And create records for each of your vendors to keep track of billing dates, amounts due, and payment due dates. If that feels like a heavy lift, c life, consider investing in expense tracking software that does the organizing for you. First, you’ll need to find your net credit sales or all the sales customers made on credit. 80% of small business owners feel stressed about cash flow, according to the 2019 QuickBooks Cash Flow Survey . And more than half of them cite outstanding receivables as their biggest cash flow pain point.

To find their accounts receivable turnover ratio, Centerfield divided its net credit sales ($250,000) by its average accounts receivable ($50,000). To identify your average collection period, divide the number of days in your accounting cycle by the receivables turnover ratio. 10 best payroll software for mac and small businesses 2021 The A/R turnover ratio tells you how quickly you can collect the money owed to you by customers who have been granted credit privileges. It also provides insight into your credit policy and whether you need to improve upon your existing A/R process and procedures.

The accounts receivable turnover ratio (A/R turnover) is a measure of how quickly a company collects its accounts receivable. It is calculated by dividing the annual net sales revenue by the average account receivables. On the other hand, having too conservative a credit policy may drive away potential customers.

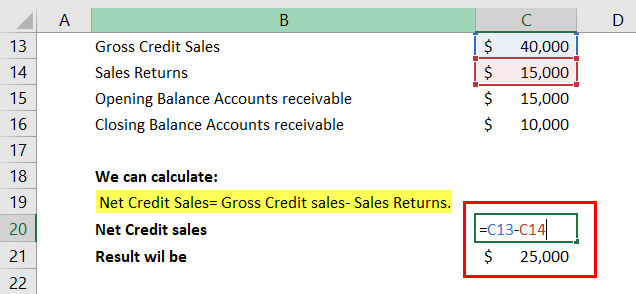

When companies fail to satisfy customers through shipping errors or products that malfunction and need to be replaced, your company’s turnover may slow. To calculate net credit sales, simply deduct sales returns and allowances from total credit sales. To calculate average accounts receivable, simply find the total of beginning and ending accounts receivable for a certain period and divide it by 2. Since it also helps companies assess their credit policy and process for collecting debts, this metric is often used by financial analysts or investors to measure the liquidity of a certain business. Determining whether your ratio is high or low depends on your business.

First, you’ll need to find your net credit sales for the year or all the sales customers made on credit. Regardless of whether the ratio is high or low, it’s important to compare it to turnover ratios from previous years. Doing so allows you to determine whether the current turnover ratio represents progress or is a red flag signaling the need for change. Alpha Lumber should also take a look at its collection staff and procedures. The business may have a low ratio as a result of staff members who don’t fully understand their job description or may be underperforming.

You can obtain this information from your profit and loss (P&L) report, also known as the income statement. Learn more about this report in our article on what a P&L statement is. To provide a broad guideline, a receivable turnover ratio of around 5 to 10 is often considered normal or healthy for many businesses. However, it’s important to note that this can vary significantly depending on the nature of the industry.

Big and small companies alike can benefit from making small friendly gestures like a friendly call or e-mail to check in. This way you will decrease the number of outstanding invoices in your books resulting in an increased receivable turnover ratio. Keep an accurate record of all sales and payments as soon as they happen. Keep copies of all invoices, receipts, and cash payments for easy reference.

On the other hand, it could also be that your collection staff members are not receiving the training they need or are not assertive enough when following up on unpaid invoices. Of course, you’ll want to keep in mind that “high” and “low” are determined by industry norms. For example, giving clients 90 days to pay an invoice isn’t abnormal in construction but may be considered high in other industries. Some companies use total sales instead of net sales when calculating their turnover ratio. This inaccuracy skews results as it makes a company’s calculation look higher. When evaluating an externally-calculated ratio, ensure you understand how the ratio was calculated.

A company could improve its turnover ratio by making changes to its collection process. Companies need to know their receivables turnover since it is directly tied to how much cash they have available to pay their short-term liabilities. For Company A, customers on average take 31 days to pay their receivables. If the company had a 30-day payment policy for its customers, the average accounts receivable turnover shows that, on average, customers are paying one day late. The denominator of the accounts receivable turnover ratio is the average accounts receivable balance.

Furthermore, accounts receivables can vary throughout the year, which means your ratio can be skewed simply based on the start and endpoint of your average. Therefore, you should also look at accounts receivables aging to ensure your ratio is an accurate picture of your customers’ payment. So, now that we’ve explained how to calculate the accounts receivable turnover ratio, let’s explore what this ratio can mean for your business. Whether you use accounting software or not, someone needs to track money in and money out.